Objective

A biotech company specializing in oncology therapies sought to acquire a late-stage asset in the antibody space to complement and strengthen its existing pipeline. The goal was to identify innovative, high-potential programs outside the typical big pharma landscape.

Approach

To ensure an objective, data-driven asset selection process, we leveraged our AI-driven Probability of Technical and Regulatory Success (PTRS) assessments and Composite Score, which were complemented by insights from our internal experts.

Methodology

Leveraging Intelligencia AI’s extensive data and analytics capabilities, we followed a systematic and multi-step filtering process to identify and prioritize acquisition targets:

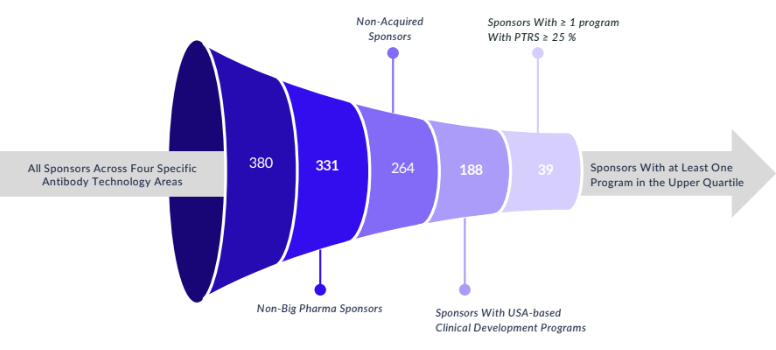

1. Initial Landscape Mapping: We identified all companies with at least one ongoing program in four specific antibody technology areas.

2. Exclusion Criteria:

- Removed Big Pharma companies to maintain focus on more agile, innovation-driven biotech firms.

- Excluded companies that had already been acquired.

- Removed companies with clinical development operations outside the U.S., ensuring regulatory alignment and operational feasibility.

3. PTRS-Based Filtering: From the selected subset, we focused only on companies with at least one program with a PTRS ≥ 25%, as calculated by our patented, AI-driven PTRS assessments. We narrowed our scope to include companies where the sponsor had at least one program ranking in the top quantile based on our proprietary PTRS distributions.

4. Refinement Based on Strategic Fit:

- We filtered out companies headquartered in Asia and those with a market capitalization above $2.5B, to align with our pharma customer’s acquisition appetite and geographic strategy.

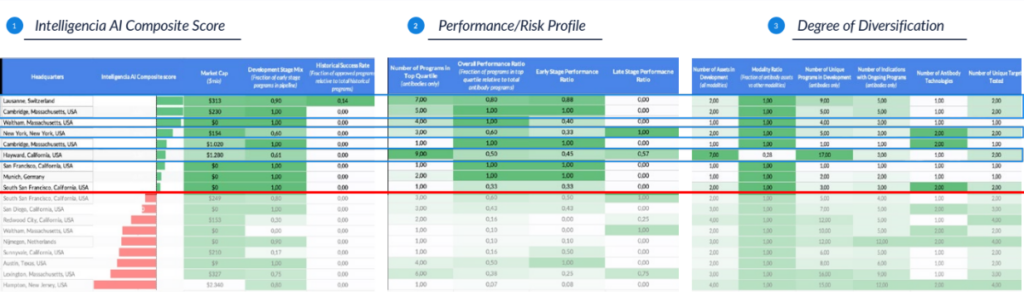

- With the remaining 18 companies, we applied Intelligencia AI’s composite score, performance/risk profile and degree of diversification to assess overall strategic and operational strength.

Outcome

The final deliverable was a shortlist of four top acquisition candidates, delivered on an accelerated timeline. These companies stood out not only due to the strong performance of their individual programs but also because of their overall company profile, operational maturity, and alignment with the client’s long-term strategy.

The AI-driven process enabled our client to act quickly and confidently in a highly competitive market, with decisions grounded in objective, data-driven evidence.