How a global pharmaceutical company used data and AI to streamline business development activities

Key Objectives

• Develop a high-level view of the oncology market landscapes for 10+ tumor types

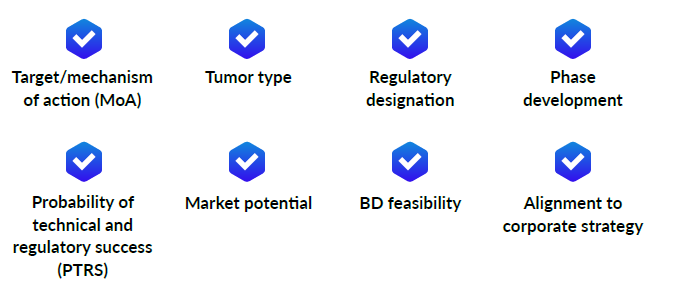

• Construct a comprehensive list of assets and priority screening criteria for business development efforts accounting for parameters such as: the organization’s strategic objectives, mechanism of action (MoA), target, clinical data and probability of technical and regulatory success (PTRS)

• Identify and develop a set of screening criteria to cut down the target assets to a short-list for business development efforts

Results and Impact

• Implemented an objective and data-focused asset prioritization approach using AI-driven methodologies and expertly curated oncology data

• Narrowed down 1,000+ oncology assets to 20 prioritized assets for business development evaluations and new product planning (NPP) within eight weeks

• Accelerated process to iterate on the criteria and to filter data rapidly throughout the project for a timely and consistent feedback loop with the pharmaceutical customer

Project Overview

Intelligencia AI™ and ZS collaborated to support a global pharmaceutical company’s Strategy and Business Development team in prioritizing assets for growth and investment opportunities. The pharma organization approached ZS to strategically review the oncology market landscape and identify attractive assets for potential in-licensing or co-development for its China division.

The market landscaping exercise focused on assessing market opportunities and unmet needs in the Chinese market and evaluated global assets from the U.S., EU, Japan and China. This landscaping exercise aimed to create a prioritized list of 20 target assets that the company’s business development group would further evaluate.

Methodology Overview

To evaluate the oncology landscape, ZS leveraged proprietary data from Intelligencia AI, subscribed data sources, and desk research to develop a comprehensive list of oncology assets in disease areas of interest for the organization. The goal was to evaluate assets across screening criteria and shortlist the most attractive assets.

Criteria used to evaluate the attractiveness of oncology assets included:

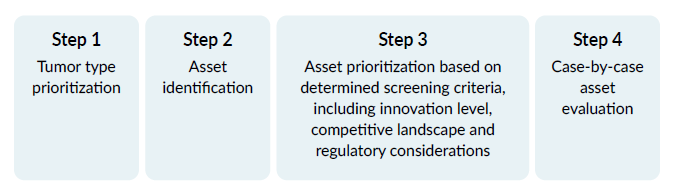

The project consisted of four main steps to identify the most promising assets for further business development evaluation.

ZS leveraged Intelligencia AI’s expertly curated data and proven AI algorithms to accelerate comprehensive asset screening and profiling and rapidly iterate on the list of assets meeting the criteria needed.

Actionable Insights From Intelligencia AI Accelerated the Process

By partnering with Intelligencia AI and leveraging its SaaS-based solution, Intelligencia Portfolio Optimizer™, ZS had access to data on pipeline assets for all cancer indications with FDA-track trials. This data was leveraged to accelerate research, validation and filtering of assets.

“By working with Intelligencia AI, their solution, and harmonized data, we completed the initial screen in about three weeks with just two team members, saving resources for our pharma customer. Based on past experiences with traditional data sources and approaches, this project typically takes four to five weeks of screening and six to seven individuals.”

– David Dang, Strategy Insights & Planning Manager, ZS

The ZS team utilized Intelligencia Portfolio Optimizer to:

- See a high-level indication overview and then deep-dive into promising programs and assets

- Access detailed PTRS benchmarks for novel therapies, which helped inform asset prioritization

- Profile and compare assets rapidly and objectively based on the billions of curated data points that underlie the Portfolio Optimizer solution

- Use AI-driven PTRS predictions to support the pharma customer in choosing candidates that outperform historical benchmarks

- Make better-informed decisions with AI, as historical averages can be misleading and hide program-level nuances and relative strengths

Results and Impact

Within less than two months, the pharma customer received a list of the 20 most promising oncology assets for the 10+ tumor types of interest. The list was generated from an initial list of 1,000+ potential assets using a set of custom criteria developed by the pharmaceutical company that assured optimal alignment with their needs and strategy.

The company’s business development team used the customized target list to focus on the most promising assets. Creating such a list was possible because the ZS team utilized Intelligencia Portfolio Optimizer, a SaaS platform that delivers on-demand access to AI-powered insights.

Within approximately three months of ZS’s evaluation, at least two of the 20 shortlisted assets had already been acquired by other large pharma companies*, signaling the high attractiveness of the shortlisted assets and validating the approach.

*Data as of Aug. 2023