This article originally appeared on Fierce Pharma.

Fierce competition. Thin pipelines. Patent cliffs. The stakes are sky-high for pharmaceutical companies and investors alike. With biotech firms often going public before generating revenue, valuations hinge on the potential for FDA approval of their assets. Herein lies the power of artificial intelligence (AI): by predicting the likelihood of success for these assets, we can uncover undervalued companies, offering a strategic edge not only to hedge funds and VCs but also to big pharma companies considering acquisitions. In this dynamic landscape, projected to see M&A activities reaching as high as $275B in 2024, the ability to discern and invest in promising biotech assets early is crucial.

At Intelligencia AI, our methodology offers a clear edge by delivering superior, real-time insights into the probability of success (PoS) for Phase 1 and Phase 2 assets gaining FDA approval. We used our predictions to create a virtual portfolio that generated 60% returns in one year and 3 out of the top 10 companies we highlighted were acquired.

This advanced predictive capability is pivotal for stakeholders to identify promising acquisition and in-licensing opportunities with a higher degree of accuracy and confidence. Our methodology has proven to be highly effective as a standalone strategy and can also complement established approaches.

Achieving Results: A Glimpse Behind the Curtain

At Intelligencia AI, we used our proprietary, patented probability of success (PoS) prediction technology to create our own virtual portfolio* of publicly traded biotech companies. Our portfolio was constructed with early-stage, pre-proof-of-concept biotech companies with oncology pipelines and a market capitalization between $100M and $1B.

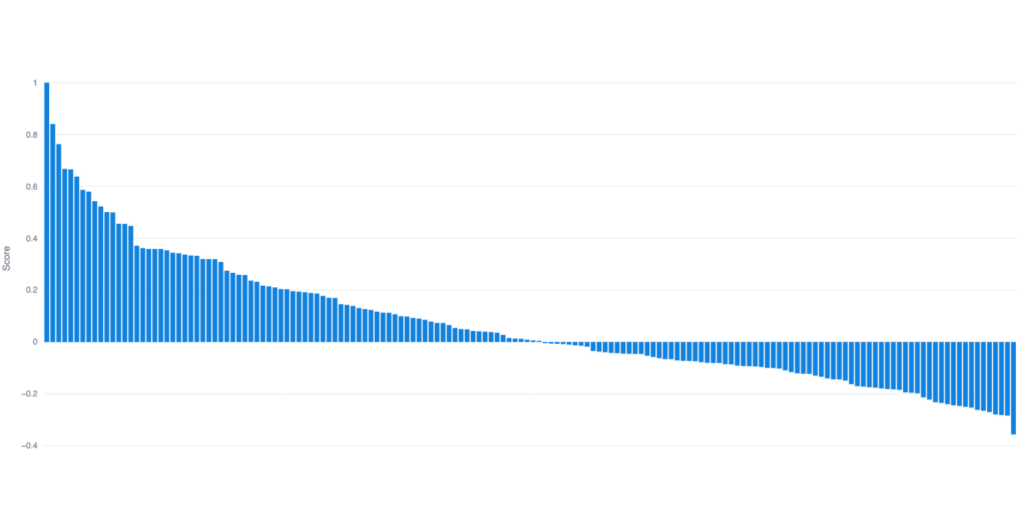

Our investment strategy focused on ranking companies based on predicted overperformance against historic benchmarks and selecting the top percentile of ranked companies. The ranked list discussed here was produced algorithmically. Overall, results can be further qualified and prioritized by our team of expert analysts when further dimensions may be relevant to our partners.

Intelligencia AI’s approach has been prospectively validated with time-stamped predictions from April 21, 2023. By March 21, 2024, Intelligencia AI’s portfolio of top 40 ranked biotechs achieved a 60% return and a Sharpe Ratio of 1.83. In comparison, similar market cap companies had a 25% return, while the biotech market benchmark index (XBI-ETF) saw a 17% return, underscoring the strategy’s effectiveness. This approach has also been back-tested over a 5-year period.

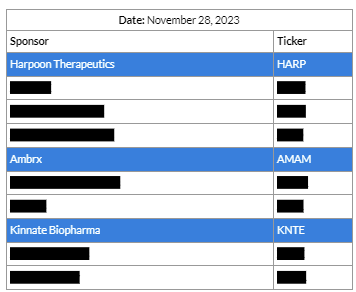

The same methodology can be applied continuously incorporating the latest information to construct the most up-to-date portfolios. We continued to construct such time-stamped profiles. Below we highlight one constructed in late November 2023 displaying top ten picks from that portfolio. Highlights include multiple recently acquired early-stage biotechs.

Harpoon Therapeutics (HARP), which has developed a portfolio of novel T-cell engagers, entered into a definitive agreement with Merck (MSD) on January 8, 2024.

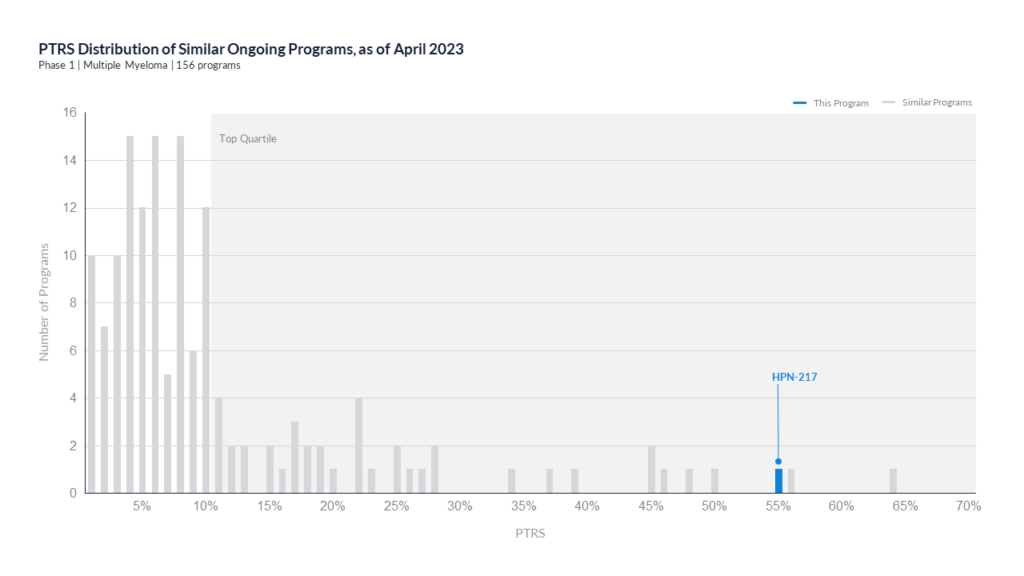

We singled out Harpoon Therapeutics’ assets in clinical development as standing out from competitive products. Both the lead candidate, HPN328 targeting T-cell engager, and HPN217 targeting B-cell maturation antigen (BCMA), were included in the acquisition.

Ambrx (AMAM), an early-stage biotech with proprietary Antibody Drug Conjugate (ADC) technology, entered into a definitive agreement with Johnson & Johnson on January 8, 2024.

We singled out two of the programs currently in early-stage clinical development as highly promising. Both novel ADC candidates, ARX788 and ARX517, were part of the acquisition.

Kinnate Biopharma Inc. (KNTE), a clinical-stage precision oncology company, entered into a definitive agreement with XOMA Corporation on February 16, 2024.

We highlighted two of their programs, Exarafenib and KIN-3248 treating melanoma and intrahepatic cholangiocarcinoma respectively, which had probabilities of success that far exceeded their expected historical benchmarks.

Better Predictions, Better Investment and Clinical Development Decisions With Validated PoS Assessments

The ability to create the above-described composite biotech scores on the basis of PoS is driven by highly accurate, prospectively validated PoS predictions for specific programs. Built on a unique, proprietary database, Intelligencia AI’s platform brings together expertly curated and harmonized clinical development, biological and regulatory data, which feeds our AI algorithms to assess drug approval and phase transition probabilities.

Our algorithms show an 83%** accuracy in predicting FDA approvals for Phase 2 oncology programs, reaching 90% retrospectively. We achieve this performance by using standard calibration techniques and continuously validating our predictions against real FDA outcomes.

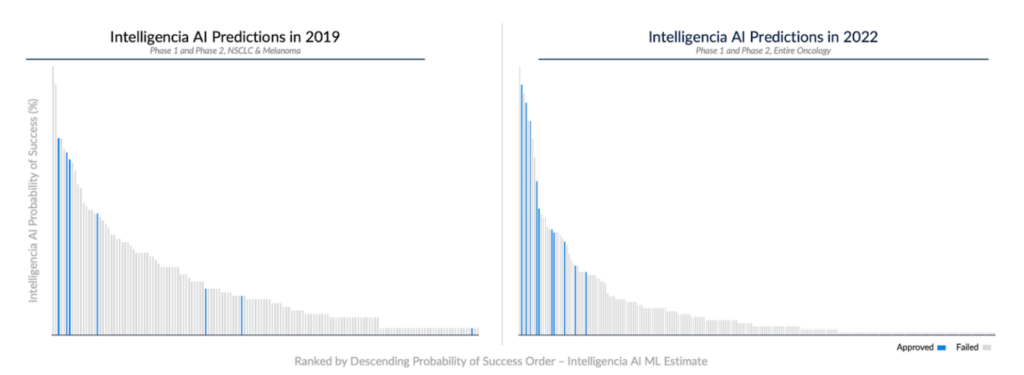

In conducting a 4-year, ongoing prospective study, we demonstrate the high accuracy of our algorithms for early-stage development programs. In 2019, we collaborated with a leading pharmaceutical company to assess PoS for all FDA-track, industry-led, interventional Phase 1 and Phase 2 non-small cell lung cancer (NSCLC) and melanoma programs.

We have been monitoring these programs since then, with 140 failures and 6 approvals. Our platform accurately predicted approval for four drugs, including novel ones and three receiving accelerated approvals: Amivantamab, Tepotinib, Tebentafusp, and Selpercatinib. Our PoS predictions for these programs were significantly higher than for those of similar-stage peers, even with relatively limited information at the time. Also, by time stamping the PoS assessments, we show that the accuracy of the PoS predictions has further improved in later releases of our algorithms.

Conclusion and Future Outlook

Our AI-driven approach in assessing biotech companies based on the risk of their development portfolio constitutes an innovative approach to identify assets for acquisition and in-licensing. The returns realized with our approach highlight its accuracy and demonstrate its capability to guide timely, informed and impactful decisions. These capabilities allow us to help our partners quickly pinpoint overlooked opportunities and realize superior returns.

As we continue optimizing the use of AI for risk assessment in drug development, we are committed to supporting life science companies in bringing groundbreaking therapies to the market and transforming patients’ lives.

To learn more and see a demo of our solutions, get in touch.

*This material is provided for informational purposes only, and it is not, and may not be relied on in any manner as investment advice or as an offer to sell or a solicitation of an offer to buy an interest in any fund or investment vehicle managed by Intelligencia AI or any other Intelligencia entity. The information and data are as of the publication date unless otherwise noted, and Intelligencia has no obligation to update such information or data. Certain information contained herein has been obtained from third-party sources. Although such content is believed to be reliable, it has not been independently verified as to its accuracy or completeness and cannot be guaranteed.

**Based on Intelligencia AI predictions as of May 2022 for oncology programs with definite announcements in 2023.