Metabolic R&D: Stable Numbers, One Breakout Story

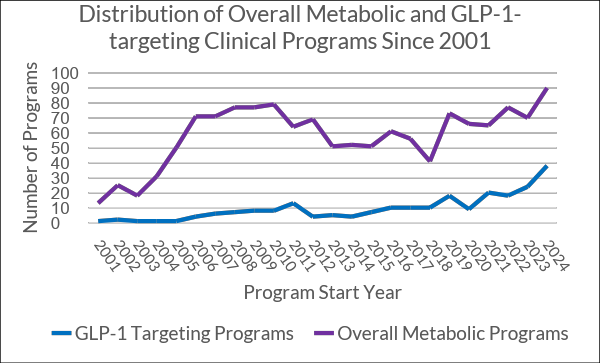

Metabolic disease R&D has historically maintained a consistent level of clinical activity, without showing meaningful growth for over a decade. Until recently, the number of active programs had barely exceeded the baseline set between 2005 and 2010. That changed following the 2021 approval of Wegovy (semaglutide), which triggered a renewed surge of interest in metabolic drug development. Since then, program counts in the space have reached levels unseen in nearly two decades.

But this momentum is far from evenly distributed. A dominant share of new activity revolves around a single mechanism: Glucagon-like peptide 1 (GLP-1) receptor agonist.

TL;DR

GLP-1 receptor agonists have reignited the metabolic disease R&D space, driving nearly 40% of all active metabolic programs since the approval of Wegovy in 2021. While this surge mirrors oncology breakthroughs in scale, GLP-1 remains largely confined to obesity and type 2 diabetes, with few programs exploring unrelated indications. The market is highly concentrated, with Novo Nordisk and Eli Lilly dominating both clinical programs and commercial impact. Success in this crowded space will depend on clear differentiation, through formulation, combinations, or niche targeting. For decision-makers, structured insights into GLP-1 trials, saturation, and competitive landscape are essential to identify true opportunities and avoid duplication.

159 out of 426 active metabolic programs — nearly 40% — involve GLP-1. Without this single mechanism, the metabolic pipeline would likely have remained stagnant. GLP-1 has, in effect, revived the category. The scale and pace of this shift mirror the rise of checkpoint inhibitors in oncology — but unlike in oncology, the biological and market space here is much narrower.

GLP-1 Is Booming — But How Much Room Is Left?

Unlike immuno-oncology, which spans dozens of genetically distinct cancers, GLP-1 development remains heavily concentrated in a small set of metabolic diseases, primarily obesity and type 2 diabetes.

Even where GLP-1 is being assessed in other contexts, it is often indirectly targeting complications or comorbidities related to these same conditions. For example, diabetic nephropathy or chronic kidney disease in diabetic populations. While this is a legitimate and potentially valuable strategy, it is inherently limited as the secondary indication must still be closely tied to metabolic dysfunction, meaning GLP-1 is not yet a truly versatile target.

Historically and currently, fewer than 10 GLP-1 programs have been conducted in immunology or central nervous system indications (e.g. asthma, osteoarthritis, Parkinson’s disease, Alzheimer’s) combined. The idea that GLP-1 can extend meaningfully beyond metabolic disease, therefore, remains largely untested — and perhaps overstated, a reflection of today’s extraordinary commercial success rather than broad biological validation.

At present, the market is exceptionally concentrated. Two companies, Novo Nordisk and Eli Lilly, control more than one-third of all active GLP-1 programs, alongside commanding positions in approved therapies and manufacturing capacity. Their lead is not only scientific but also commercial: GLP-1 products have contributed tens of billions in additional market capitalization for both firms over the past two years, reshaping investor and competitive dynamics across the metabolic sector.

One Potential Path Forward: Indication Shifts and Smart Positioning

Some sponsors have begun repositioning GLP-1 toward new, less saturated indications. Boehringer Ingelheim, for example, has three of its four active GLP-1 programs in Phase 3, with two of them focused on MASH (Metabolic Dysfunction-Associated Steatohepatitis). This signals an intent to extend GLP-1 utility beyond its current metabolic epicenter into diseases still linked to metabolic dysfunction but outside the diabetes/obesity mainstream.

However, for most entrants, the path forward will demand clear differentiation — through formulation, combination strategy, or targeting of niche subpopulations. In a space this crowded, the margin for incremental value is narrow— only programs offering measurable advantages in outcomes, delivery, durability, or access strategy are likely to stand out.

What Decision-Makers Competing in Crowded, Shifting Landscapes Need

Our clinical intelligence and benchmarking platform bring clarity to fast-moving areas like GLP-1, where innovation is real, but so is market saturation.

- Clinical development teams gain structured insights into trial design and historical benchmarks across the GLP-1 landscape, helping distinguish differentiated approaches from those simply mirroring dominant players.

- Portfolio strategists receive quantified saturation data and modality-level benchmarks by sponsor, phase, and indication, which guides sharper decisions around entry points and resource prioritization.

- Business development leads are supported with mechanism- and sponsor-level overlap analytics, enabling faster due diligence and early signal detection when scanning for white space or undervalued opportunities.

In a category where success may already be spoken for, we help teams make confident, data-driven decisions about where to double down — and when to pivot.

For more tailored, data-rich insights, let’s talk.