ASH continues to serve as the premier annual venue where early clinical signals, emerging modalities, and mechanistic innovation in hematology are brought to the forefront. As modalities evolve—from next-generation cell therapies to synthetic biology platforms and precision small molecules—the meeting acts as a nexus where data informs strategy. For biopharma decision-makers, investors, and clinical stakeholders, ASH provides unmatched visibility into programs that are redefining therapeutic boundaries.

Intelligencia AI integrates model-derived insights, competitive intelligence, and domain expertise to evaluate programs approaching pivotal milestones. While the goal is not to predict outcomes of individual trials, our approach identifies assets with a convergence of favorable scientific, clinical, and developmental drivers suggesting high strategic importance.

TL;DR

ASH 2025 highlights cutting-edge hematology innovations, from next-generation CAR-T and TCR-T therapies to logic-gated NK platforms and allosteric small molecules. Intelligencia AI’s PTRS methodology identifies programs with high strategic potential by combining data-driven modeling and expert validation. The six featured programs showcase scientific novelty, competitive positioning, and development momentum, providing decision-makers with actionable insights ahead of the conference.

Methodology

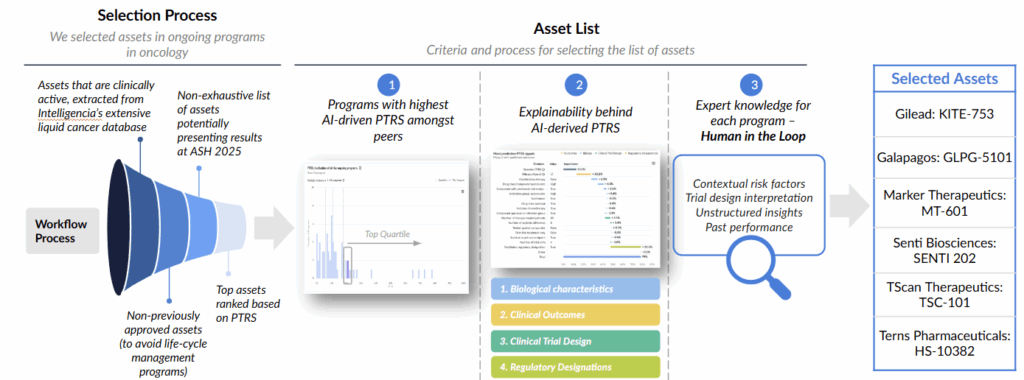

Our watchlist methodology is grounded in Intelligencia AI’s Probability of Technical and Regulatory Success (PTRS) framework, which combines data-driven modeling with expert review to surface the most promising liquid cancer programs.

Step 1: Asset Identification

We start by surveying all actively developing liquid oncology programs in our database. Any asset whose main drug has already achieved regulatory approval—whether in another indication or a different patient group—is excluded. This ensures the focus remains on emerging, unapproved candidates rather than established products undergoing life-cycle extensions.

Step 2: PTRS-Based Ranking

Next, we apply our AI-powered PTRS model to the filtered set of assets. The model draws on biological features, clinical readouts, trial design parameters, and regulatory signals. It also integrates unstructured insights and contextual risk considerations, producing a balanced assessment that reflects both potential upside and development uncertainty.

Step 3: Expert Validation (“Human in the Loop”)

Scientific and clinical experts then review the model outputs. Their evaluation helps contextualize the data, interpret trial design subtleties, and incorporate additional domain knowledge that complements the quantitative assessment. This step ensures that the ranking reflects both analytical rigor and practical scientific perspective.

Step 4: Watchlist Selection

Using the combined model results and expert evaluation, we identify the assets most likely to deliver meaningful data or influence strategic thinking. Selected programs typically rank among the highest in PTRS within their peer groups and also demonstrate notable scientific differentiation, novelty, or broader applicability.

Workflow Overview

- Identify active assets using the Intelligencia AI oncology database.

- Apply PTRS modeling to generate ranked peer-group comparisons.

- Validate clinical and scientific relevance through expert review.

- Highlight assets with the strongest potential impact at upcoming conferences.

Consistent Validation of Methodology

This methodology has been stress-tested in prior conferences, including ASCO 2025 and ESMO 2025, where our watchlists correctly anticipated assets that went on to deliver positive, differentiated outcomes.

At ASCO 2025, all five companies identified in our pre-conference analysis—Allogene Therapeutics, BioAtla, Actuate Therapeutics, Zai Lab, and Perspective Therapeutics—subsequently presented meaningful clinical advances. Similarly, at ESMO 2025, NVL-655, EVX-01, CRB-701 and CS2009, all assets featured in our pre-conference watchlist went on to display positive clinical outcomes This validated the predictive power of our PTRS methodology as both a scientific and strategic tool.

Our proprietary company score leverages our AI-driven PTRS assessments.

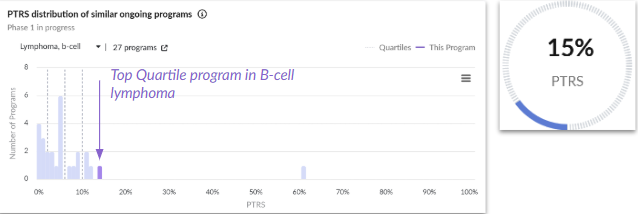

1. KITE-753: Dual-Antigen, Rapid-Manufacture CAR-T Re-Engineering to Out-pace CD19 Escape in Relapsed / Refractory B-Cell Lymphomas (Gilead)

Indication: B-cell lymphoma

Trial: Ph1, NCT04989803

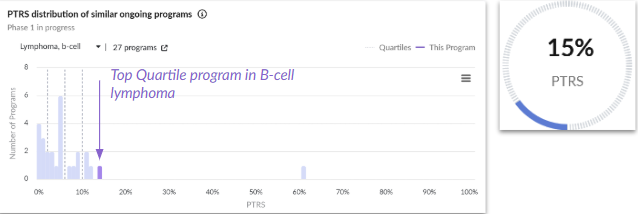

Probability of technical and regulatory success (PTRS) relative to the competitive landscape.

Drug Characteristics:

- Autologous, rapidly manufactured bicistronic CD19/CD20 CAR T product designed for relapsed/refractory B-cell lymphomas.

- Incorporates two co-stimulatory domains (CD28 and 4-1BB) to enhance T-cell activation, expansion, and persistence while aiming to maintain a manageable safety profile.

Why it matters:

- Dual targeting of CD19 and CD20 seeks to reduce antigen escape, a recognized mechanism of relapse after CD19-only CAR T.

- Rapid manufacturing and alignment with existing CAR T workflows may translate into shorter vein-to-vein times and earlier treatment in aggressive disease.

Competitive Positioning

- Competes against approved CD19 CAR-Ts: Yescarta (Gilead), Kymriah (Novartis), Breyanzi (BMS).

- Differentiates via dual-targeting (CD19/CD20), unlike single-antigen approved CAR-Ts.

- Potential advantage over bispecifics (e.g., Mosunetuzumab, Genentech; Glofitamab, Roche) if durability proves superior.

- Kite’s emerging rapid manufacturing platform may create logistical advantages vs. traditional autologous CAR-Ts.

- Must demonstrate meaningful improvement in durability and resource utilization to stand out in a crowded B-cell lymphoma space.

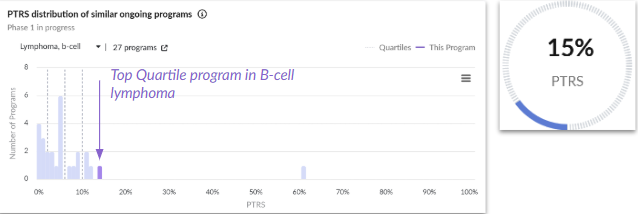

2. GLPG-5101: Fresh, Stem-Like Early-Memory CAR-T with 7-Day Vein-to-Vein and RMAT Momentum for High-Risk R/R NHL (Galapagos)

Indication: Diffuse large B-cell lymphoma

Trial: Ph1/2, NCT06561425

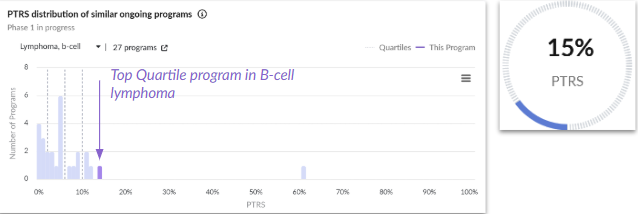

Probability of technical and regulatory success (PTRS) relative to the competitive landscape.

Drug Characteristics:

- CD19-directed CAR T therapy using a fresh, stem-like early-memory T-cell phenotype rather than cryopreserved product.

- Developed with a 7-day vein-to-vein time in the ATALANTA-1 program, aiming to deliver “fresh, fit” CAR T cells in relapsed/refractory NHL, including DLBCL and mantle cell lymphoma.

Why it matters:

- In aggressive lymphomas, time to infusion is critical; a 7-day process directly targets this bottleneck and may be particularly relevant for unstable or rapidly progressing patients.

- Early clinical data suggest high response rates (69% ORR), including deep MRD negativity, alongside low rates of high-grade CRS/ICANS, supporting the “fit, early-memory” design hypothesis.

Competitive Positioning:

- Competes with autologous CD19 CAR-Ts: Yescarta, Kymriah, Breyanzi.

- Distinguishes itself with a 7-day fresh-product process, faster than most commercial products.

- Alternative cell therapy competitors include FresCAR-T (Fresenius Kabi) and allogeneic programs like ALLO-501 (Allogene).Potential to outperform legacy CAR-Ts in time-sensitive aggressive lymphomas if rapid manufacturing reduces dropout rates.

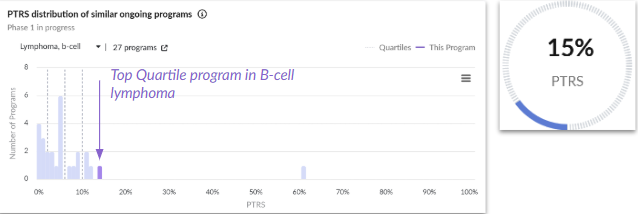

3. MT-601: Multi-Antigen Recognizing (MAR-T) T-Cell Therapy Targeting Six Tumour Antigens to Address Post-CAR-T Relapse in High-Risk NHL (Marker Therapeutics)

Indication: Non-Hodgkin lymphoma

Trial: Ph1, NCT05798897

Probability of technical and regulatory success (PTRS) relative to the competitive landscape.

Drug Characteristics:

- MT-601 is a Multi-Antigen Recognizing (MAR-T) cell therapy, engineered to target multiple tumor-associated antigens in B-cell lymphomas.

- Early data show encouraging response rates (e.g., ORR ~66% and CR ~50% in a subset of heavily pretreated NHL patients), with a favorable safety profile and no DLTs or ICANS reported to date in dose escalation.

Why it matters:

- Multi-antigen targeting is designed to mitigate antigen loss and heterogeneity, a key mechanism of relapse after single-antigen therapies such as CD19 CAR T.

- Demonstrating activity in patients relapsing after CAR T would address a major unmet need where current salvage options are limited and outcomes are poor.

Competitive Positioning:

- Targets the post–CAR-T relapse segment, where few options exist; indirect competitors include Epcoritamab (AbbVie/Genmab) and Glofitamab (Roche).

- Favorable early safety profile may offer advantages over bispecific antibodies with higher CRS rates.

- Positioned as a salvage platform rather than competing head-to-head with frontline CAR-Ts.

- Potential platform expansion could create a differentiated foothold across multiple NHL subtypes.

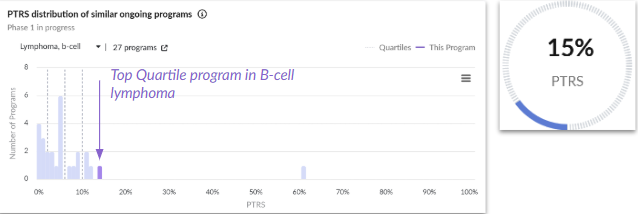

4. SENTI-202: Off-the-Shelf Logic-Gated CAR-NK for AML Using CD33/FLT3 OR-Gate and EMCN NOT-Gate to Spare Normal Hematopoiesis (Senti Biosciences)

Indication: Acute myeloid leukemia

Trial: Ph1, NCT06325748

Probability of technical and regulatory success (PTRS) relative to the competitive landscape.

Drug Characteristics:

- SENTI-202 is an off-the-shelf CAR NK cell therapy incorporating a logic-gated gene circuit with three chimeric proteins.

- Features a bivalent OR-gate activating CAR that can be triggered by CD33 and/or FLT3, addressing antigen heterogeneity and aiming for more robust AML cell recognition.

Why it matters:

- AML has limited success with CAR T approaches, given target overlap with normal myeloid cells; logic-gated engineering offers a precision approach to targeting CD33/FLT3 while attempting to limit myelosuppression.

- The off-the-shelf NK platform avoids the need for leukapheresis and lengthy manufacturing, which is particularly important in rapidly progressive AML.

Competitive Positioning:

- AML cell-therapy competition is minimal; no approved CAR-Ts — key comparators are targeted drugs like Gilteritinib (Astellas) and investigational bispecifics.

- Logic-gated CAR-NK design (CD33/FLT3) is unique vs. single-target programs (e.g., CD33 CAR-Ts like AMG 330, Amgen).

- Must demonstrate durable activity to avoid being eclipsed by emerging AML bispecifics (e.g., Flotetuzumab, MacroGenics).

- Potential to define a new AML immunotherapy category, given limited competition in post-relapse settings.

5. TSC-101: HA-2-Specific Allogeneic TCR-T Therapy for Post-Transplant Leukemia Control Targeting Minor Histocompatibility Antigen in HLA A*02:01 Patients (TScan Therapeutics)

Indication: Acute myeloid leukemia

Trial: Ph1, NCT05473910

Probability of technical and regulatory success (PTRS) relative to the competitive landscape.

Drug Characteristics:

- TSC-101 is an HA-2–specific TCR-T cell therapy targeting a minor histocompatibility antigen expressed on all blood cells, malignant and benign, in HLA-A*02:01–positive patients.

- Evaluated in the Phase 1 ALLOHA trial, with updated data showing promising elimination of recipient hematopoiesis and laying the groundwork for a pivotal study design agreed with FDA.

Why it matters:

- Post-transplant relapse remains a major cause of treatment failure in AML, and current strategies (DLI, maintenance, hypomethylating agents) offer limited, variable benefit.

- By specifically targeting HA-2, TSC-101 aims to enhance graft-versus-leukemia effects while potentially avoiding the non-specific toxicity associated with broader immunomodulation.

Competitive Positioning

- Operates in the post-allo-HCT relapse-prevention niche, where standard alternatives include DLI, HMAs ± Venetoclax (AbbVie/Roche).

- HA-2–specific TCR-T offers antigen-selective activity not present in competitors like WT1-targeted TCR-Ts (various sponsors).

- Narrow HLA-A*02:01 population reduces direct competition but also concentrates value in a defined segment.

6. HS-10382 (TERN-701): Next-Generation Allosteric BCR::ABL1 Inhibitor Overcoming T315I and ATP-Site Resistance in CML (Terns Pharmaceuticals)

Indication: Chronic myeloid leukemia

Trial: Ph1, NCT06163430

Probability of technical and regulatory success (PTRS) relative to the competitive landscape.

Drug Characteristics:

- HS-10382 (also known as TERN-701) is an oral, potent, selective allosteric inhibitor of BCR-ABL1, binding the myristoyl pocket rather than the ATP site.

- Demonstrates high potency against wild-type BCR-ABL1 and many clinically relevant resistance mutations in preclinical models.

Why it matters:

- Resistance and intolerance to first- and later-generation ATP-competitive TKIs remain unmet needs in CML, particularly in patients with difficult mutations or long-term toxicity.

- As an allosteric inhibitor, HS-10382 offers a non-overlapping mechanism that may retain activity against some ATP-site mutations and enable deep, sustained molecular responses, especially in combination.

Competitive Positioning

- Competes with ATP-competitive TKIs (Imatinib, Dasatinib, Nilotinib, Bosutinib, Ponatinib) and the existing allosteric inhibitor Asciminib (Novartis).

- Needs to demonstrate clearer tolerability and resistance-coverage advantages vs. Asciminib to occupy meaningful market share.

- Combination potential with ATP-competitive TKIs could position HS-10382 as a deep-remission strategy, not just a rescue agent.

Conclusion

The six programs highlighted here reflect the accelerating pace of scientific and clinical innovation heading into ASH 2025. They span next-generation CAR-T cell therapies, logic-gated NK platforms, precision TCR-T designs, and allosteric small-molecule inhibitors—each addressing long-standing challenges in hematologic malignancies through distinct mechanistic and developmental strategies.

What unites them is not only their scientific ambition but also the strong, data-grounded momentum captured through our AI-driven PTRS analysis. By integrating biological detail, trial-design sophistication, contextual risk factors, and expert interpretation, our assessment goes beyond surface-level readouts to illuminate the true signal beneath early and often incomplete datasets.

While the trajectory of clinical outcomes remains to be seen, each program stands at the intersection of meaningful novelty, competitive relevance, and potential strategic impact. For decision-makers across hematology—clinicians, developers, and investors—these are the assets worth watching closely as ASH 2025 unfolds.

For more tailored, data-rich insights, let’s talk.