We’ve been spending a lot of time lately going deep into our clinical development data—not just running models, but wondering:

• Where are the less obvious opportunities hiding?

• Where are the assumptions that might need updating?

That digging has surfaced some insights we thought you’d find valuable.

This is the first in a series of The Insight Drop, where we’ll share the kind of sharp, actionable takeaways that don’t usually make it into the standard reports. Not on a schedule, not behind a paywall—just when we uncover something worth your time.

We’re kicking it off with a look at emerging modalities in oncology—specifically, how ADCs, bispecifics and CAR-Ts are performing in late-stage development (spoiler: better than you might think).

High Risk, High Reward Beyond the Usual Suspects

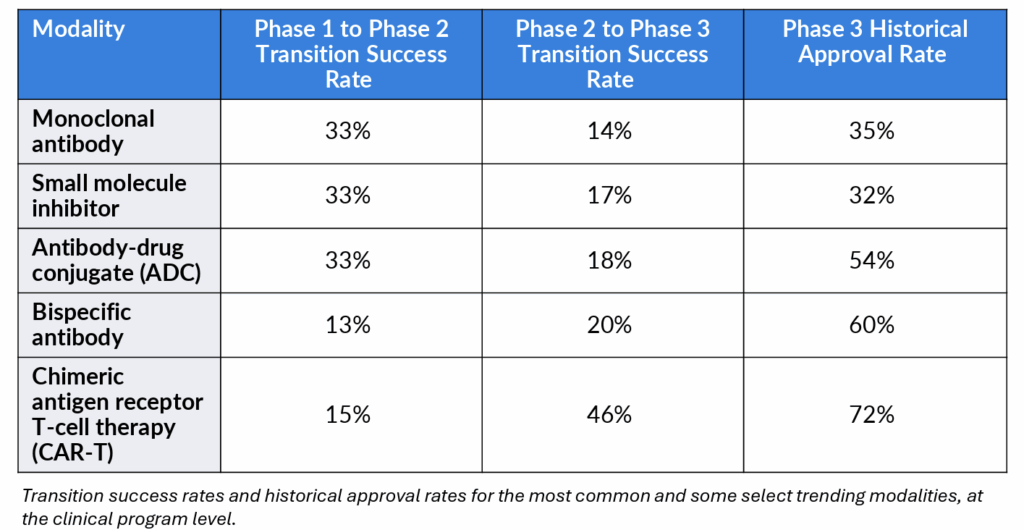

In oncology drug development, monoclonal antibodies (mAbs) and small molecule inhibitors (SMIs) continue to dominate the landscape, with over 9,500 historical clinical programs (comprised of interventional, industry-led, FDA-track clinical trials) to date. Their prevalence reflects decades of established safety data, clear regulatory pathways and operational familiarity. Unsurprisingly, both show relatively high Phase 1-to-Phase 2 transition success rates (33% each), likely due to well-understood risk profiles.

However, when it comes to late-stage progression and approvals, newer modalities are quietly outperforming.

• ADCs now account for over 50% of all programs across our “trending” modality segment (~1,000 programs total, consisting of the historical entirety of ADCs, CAR-Ts and bispecific antibodies). Their Phase 3 approval rate stands at 54%, significantly higher than that of mAbs (35%) and small molecules (32%).

• Bispecific antibodies, though still limited in volume, face the lowest Phase 1 success rate (13% Phase 1 success) among all modalities—but once they reach Phase 3, they boast a 60% approval rate, the second-highest in this analysis.

• CAR-Ts show a steep early-stage attrition rate (15%). Yet their Phase 2 transition success rate jumps to 46%, and their approval rate in Phase 3 peaks at 72%, the highest observed across these modalities.

These benchmarks reveal a clear pattern: while emerging modalities are risk-heavy upfront, their late-stage performance suggests significant risk discharging. But that hinges on overcoming early development barriers—typically linked to manufacturing complexity, toxicity management and patient selection challenges.

Implications for Strategic Portfolio Planning

The data suggests that sponsors should re-evaluate risk–reward assumptions around less common modalities. Targeted investment in early-phase support for bispecifics, ADCs, and CAR-Ts could unlock disproportionately high value downstream if progression through Phase 1 and 2 is de-risked through better trial design and patient targeting.

Intelligencia AI: How We Fit Into the Equation

Our platform enables portfolio teams to:

• Benchmark transition and success rates across modalities, indications and phases, helping teams prioritize assets and investments based on empirical probabilities

• Identify where emerging modalities are most likely to succeed based on historical patterns, allowing for more focused development strategies and smarter risk allocation

• Apply predictive analytics as a bespoke service to optimize trial design and de-risk early-stage development

For companies willing to invest early and strategically, these trending modalities offer an outsized return on clinical risk.