A Story of Promise, Pressure and Portfolio Impact

Janus kinase (JAK) inhibitors emerged over the last decade as a breakthrough mechanism of action (MoA) in Immunology & Inflammation (I&I), offering oral alternatives to biologics across a range of indications—rheumatoid arthritis, ulcerative colitis, atopic dermatitis (AD) and others. Their oral administration, broad immunomodulatory potential, and early success in autoimmune conditions made them a cornerstone of many pipelines.

However, in 2021, the U.S. FDA issued class-wide boxed warnings on all JAK inhibitors for inflammatory diseases. These were based on large post-marketing trials showing increased risks of cardiovascular events, malignancy, thromboembolism and all-cause mortality—especially in older or high-risk patients. In response, JAK inhibitors were repositioned from frontline agents to later-line use, dramatically impacting both clinical development and investment appetite.

Insights From the Data: What the Numbers Reveal

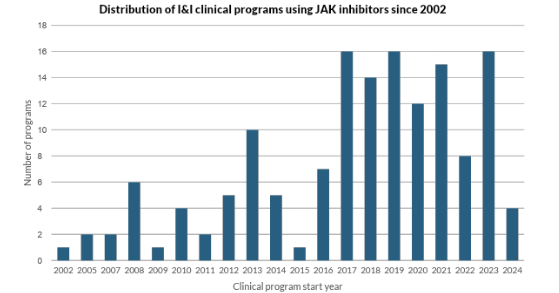

Our proprietary clinical trial dataset captures the ripple effects of this regulatory disruption:

- In 2022, new JAK inhibitor program initiations fell sharply, reflecting cautious reprioritization by sponsors and shifting investment away from the class.

- In 2023, the field saw a temporary resurgence, largely driven by dermatology programs. Almost half of new programs that year were in atopic dermatitis, buoyed by recent approvals of abrocitinib and upadacitinib—signaling that targeted regulatory wins can still trigger reactive interest.

- However, by 2024, new program starts declined once again, suggesting that confidence in the broader class remains fragile and conditional.

- With only a few months remaining in 2025 and only five JAK-related programs launched, the trendline points to a marked and sustained pullback—especially outside of dermatology.

While the overall trajectory suggests diminishing industry confidence, the class is not beyond redemption. Should future trials demonstrate improved safety profiles or secure regulatory endorsement in new indications, JAK inhibitors may yet re-emerge as strategically viable assets.

Regulatory Gravity: A Double-Edged Sword

This case offers a clear example of how regulatory positioning can reshape an entire MoA’s trajectory:

- Positive regulatory signals—such as targeted approvals in AD—can briefly rejuvenate a class.

- But broad safety concerns, when applied across all agents, can rapidly dampen both innovation and capital allocation, even in otherwise promising therapeutic areas.

This push-pull dynamic reinforces the importance of strategic timing, indication selection, and evidence generation when developing or acquiring assets in highly scrutinized classes.

Strategic Clarity When the Landscape Shifts

For portfolio managers, business development teams and clinical strategy leads, navigating volatility around mechanisms like JAK inhibitors requires more than reactive tracking. It demands forward-looking visibility.

Our platform delivers that through:

- PTRS modeling grounded in historical precedent and real-time regulatory context, enabling teams to quantify the true likelihood of success for any program — not just by MoA, but also by line of therapy, indication, trial design and regulatory exposure.

- Comparative success benchmarks across thousands of clinical programs, giving BD teams the ability to assess whether an asset’s probability profile truly justifies its risk and investment — especially in saturated or reputationally burdened MoAs like JAK inhibitors.

- Bespoke analytics support for strategic teams seeking to interpret subtle shifts in trial initiation behavior, competitive momentum, or sponsor-level portfolio changes — offering contextualized insights that complement automated outputs.

Answer critical questions with greater confidence. Is this asset still viable? Are we too early — or too late? Where is the data heading, and how should we act before the market does?