TL;DR

Cell therapies in multiple sclerosis are accelerating rapidly, with most programs initiated in the last two years and 2026 already tracking above trend. However, no MS cell-therapy program has progressed beyond Phase 2, meaning the market is investing in potential—not proof. The key inflection point will be whether upcoming Phase 2 data show clinically credible efficacy, durable immune impact, manageable safety, and a scalable path to Phase 3. Until then, momentum reflects optionality, not validation.

MS has been a two-modality market—by design

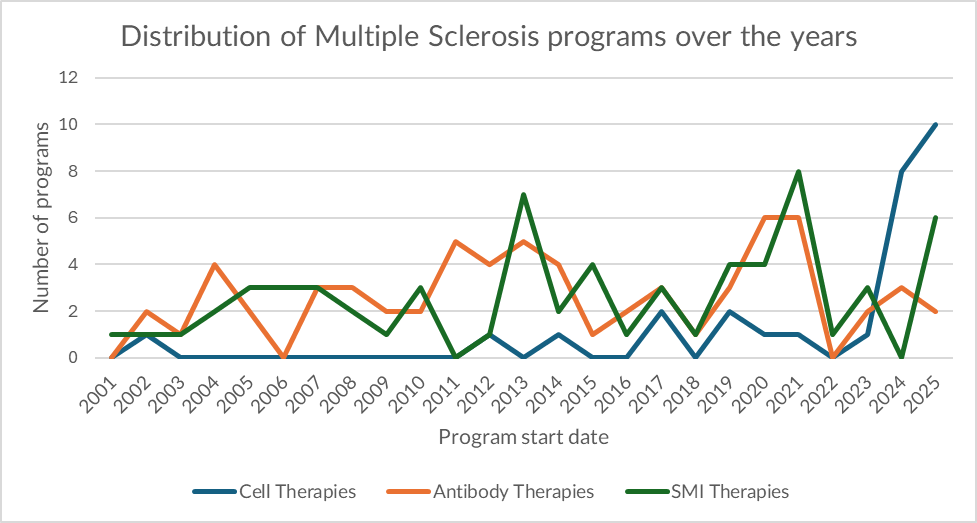

For most of the last two decades, monoclonal antibodies and small-molecule inhibitors (SMIs) have defined the commercial and clinical backbone of multiple sclerosis (MS). Our clinical program dataset shows that ~82% of MS programs since 2001 have sat in these two modalities, reflecting what the market has historically rewarded in MS: scalable immunomodulation, repeatable trial architectures, and regulatory familiarity.

The modality curves also reveal two distinct innovation patterns:

- SMIs exhibit “wave” behavior: higher peaks that coincide with periods of enthusiasm for oral convenience and newly druggable immune targets. In our data, SMIs reach their highest annual initiation level in 2021 (8 new SMI programs)—a spike consistent with a competitive cycle where oral mechanisms draw rapid exploration, followed by consolidation.

- Antibodies dominate through persistence: while SMIs spike, antibodies remain the consistent anchor. Antibody program initiations peak at 6 in both 2020 and 2021, and remain a recurring “default” modality as the field returns to mechanisms perceived as broadly reliable (notably B-cell biology and immune trafficking).

This is what a mature modality market looks like: incremental innovation, predictable investment logic, and a relatively stable mix of trial activity.

The discontinuity: cell therapy accelerates—fast

Over the last two years, that stability breaks.

In our dataset, cell therapies jump from background noise to a leading growth driver. In 2024 and 2025, cell therapies account for 18 of the 28 total cell-therapy MS programs initiated since 2001 (~64%)—a sharp concentration in a very short window.

Even more notable: 2026 is already tracking above trend. While the year is only two months in, 9 new MS cell-therapy programs have already been initiated, nearly matching the entirety of 2025 (10 new cell-therapy programs). That early-year velocity is consistent with an “explosive” year-ahead if the pace holds.

The core tension is maturity. Despite the surge, no MS cell-therapy program has progressed beyond Phase 2 (in our clinical record). That puts the current wave in a specific category: high momentum, limited precedent—where investment is driven by optionality rather than proven registrational pathways.

Why Now: Four Forces Behind the Shift

- Engineered cells have become credible in autoimmunity—not just oncology

The center of gravity for cell therapies is expanding into immune-mediated disease, with a growing view that deep immune “reset” concepts may translate beyond cancer. ECTRIMS has explicitly positioned CAR-T exploration as a serious MS research direction. - MS biology increasingly supports “reset” logic, not only chronic suppression

The MS narrative has shifted toward durable immune modulation—particularly around B-cell–driven mechanisms. This makes cell-based strategies conceptually compelling: if a program can produce longer-lasting immune reprogramming than chronic dosing, it could redefine therapeutic expectations in selected patients. - Progressive MS keeps pulling capital toward higher-upside approaches

Progressive disease remains the most valuable unresolved segment, where differentiation is rare and the bar for meaningful benefit is high. That scarcity sustains appetite for higher-risk modalities, even before late-stage precedent is established. - Early clinical signals are mixed—but keep the hypothesis alive Not all signals have supported the thesis. For example, Atara’s ATA188 in progressive MS did not meet its Phase 2 primary endpoint—an important reality check for the category. Still, the broader autoimmune cell-therapy narrative has been strong enough to sustain investment while sponsors look for clearer Phase 2 signal quality.

Trend or fad: the executive take

The current uptrend is directionally understandable. Cell therapies offer a value proposition that incumbents do not fully replicate: the possibility of durable immune reprogramming rather than continuous long-term treatment. If that translates into sustained disability stabilization, longer treatment-free intervals, or durable biomarker shifts that matter clinically, the modality could reshape the MS landscape—especially where today’s approaches plateau.

However, the limiting fact remains decisive: MS cell therapies have not yet crossed into Phase 3. That means the market is still paying for optionality, not proof. In MS, Phase 3 is where the hardest problems converge: endpoint strategy, patient stratification, durability claims, safety management, and operational feasibility at scale.

For decision-makers, the practical implication is straightforward: volume is not validation. The investable signal in 2026 will not be how many programs start—it will be whether Phase 2 programs demonstrate:

- clinically credible efficacy signals aligned with MS progression biology,

- a defensible safety and monitoring profile for chronic neurologic patients,

- a feasible path to scalable delivery and reimbursement

How we support decision-makers assessing early modality shifts

When modality momentum outpaces late-stage precedent, disciplined decisions require phase-specific context—historical, competitive, and practical.

For clinical development leaders, we provide benchmarking on MS trial architectures and outcome expectations by modality and phase, helping teams assess whether a cell-therapy program is designed to clear the hurdles that have historically prevented progression beyond Phase 2.

For portfolio strategists, we quantify whether the current surge reflects durable platform adoption or concentrated experimentation—so prioritization and capital allocation align with evidence maturity rather than market noise.

For BD and licensing teams, we contextualize opportunities against historical MS development patterns—modality crowding, phase-progression dynamics, and precedent signals—so diligence focuses on differentiation that is likely to matter at registrational scale.

MS cell therapies may represent the next chapter—but today’s momentum is still an early signal; we help teams price that signal with rigor.

For more tailored, data-rich insights, let’s talk.